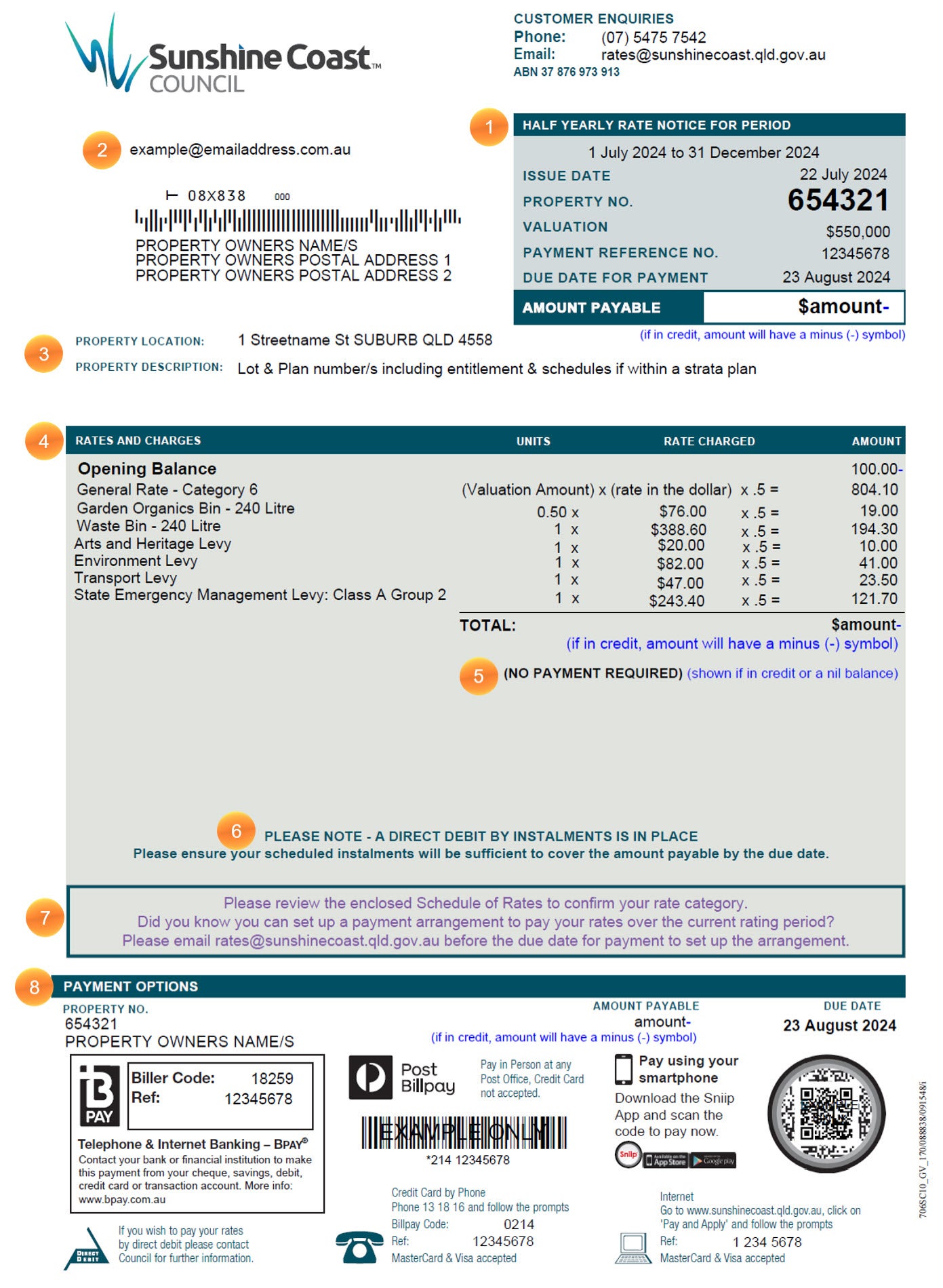

Your rate notice explained

This page explains the information shown on your rate notice. Each numbered item in the sample rate notice is explained in the guide below.

Note: This example has been prepared as a guide only, the information and figures may not be a true reflection of a current rate notice.

Your guide to reading your rate notice details

1. Rate notice details

1. Rate notice details

Rate notice period

Council issues rates notices twice a year:

- in January for the 6 month period of 1 January to 30 June, and

- in July for the 6 month period of 1 July to 31 December.

Issue date

The date of the rate notice issue.

Property no.

This is your unique council reference number if you contact council regarding your property.

Valuation

The valuation issued by the Department of Resources to council.

Payment reference no.

This is your unique payment reference number to be used in the payment options.

Amount payable

This is the amount payable by the due date. If the amount is a credit, it will display with a - (minus) symbol on the end. See item 5 below if a credit is shown.

2. Notices received by email

2. Notices received by email

If you have registered with council to receive your rate notice via email, this is email address used to issue your rate notices.

3. Property details

3. Property details

Property location

The rates and charges are for this property address.

Property description

This is the legal description of the property, as per the title deed.

4. Rates and charges

4. Rates and charges

Some rates and charges explained below may not display on your rate notice if not applicable or relevant for your property.

Opening balance

This is your rate account balance prior to the issue of this notice. A credit is shown with a -(minus) symbol on the end as in this example.

Overdue rates and charges

If the rates were not paid in full before the rate notice was created, the first line on your rate notice will show the overdue amount.

Differential general rate category

Information on your differential general rate category can be found on the schedule of rates (PDF, 331.1KB) enclosed with your rate notice, online at rates information, or online in council’s current financial year revenue statement (PDF, 6MB).

A calculation at rate in the dollar for a valuation of $550,000 at Category 6:

$550,000 x 0.2924* = $1,608.20 x 0.5 (half year) = $804.10. This is above the minimum amount of $738.50 for Category 6, therefore; this amount is charged.

If the result of the calculation (the rateable value multiplied by the cents in the dollar charge) is below the Minimum Rate for the rate category, the Minimum Rate is charged.

*The cents in the dollar for the rate category shown in the schedule of rates. This is divided by 100 to calculate the charge as it is a cent in the dollar amount.

Waste management charges

Your waste bin collection charges. Full information can be found online in council’s current financial year revenue statement (PDF, 6MB).

Other charges - separate levies

Levies charged on all rateable land:

- arts and heritage levy

- environment levy, and

- transport levy.

Special charges

A charge levied on some, rateable land for activities and/or services over and above the standard level of service or activity applied by council for specific areas.

State emergency management levy

Council is required to collect this levy on behalf of the State Government. This levy is charged on property use and location for each property lot/s. Further information can be found at: https://www.qfes.qld.gov.au/planning-and-compliance/em-levy.

Other items

Your rate notice may include other items not shown on the sample rate notice such as state government pensioner rate subsidy, council pension concession, differential general rate concessions, differential general rate deferments, change of ownership fee, valuation fee, backflow charges, overdue clearing land/noxious weeds and overdue infrastructure charges.

5. No payment required

5. No payment required

If your rate account is a nil balance or a credit, the rate notice will display as (NO PAYMENT REQUIRED).

6. Direct debit by instalments

6. Direct debit by instalments

This is confirming you have a current direct debit payment agreement in place with council. Please note a direct debit is a payment method, and not an arrangement to pay* rates by instalments.

*You can request an arrangement to pay your rate notice by instalments by clicking on the “pay and apply” menu on our website.

7. Information

7. Information

This information is to remind you to check your differential general rate category is correct for each rate notice you receive by reviewing the rating category statement that is issued with your rate notice and may be viewed on our rates information webpage.

8. Payment options

8. Payment options

This section explains your payment options, including directly and securely online using MyCouncil.